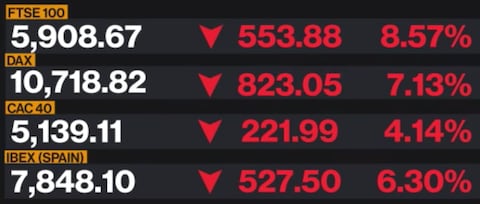

To me the biggest surprise is why did it take so long to react? When the Chinese manufacturing took a hit from the virus, that should have sparked the sell off as other industries around the world would have shortage of parts to assemble their products resulting in slow down and layoff at many factories around the world. I expected to see the sell off much sooner as worldwide supplies would be effected. I do not see a turn back around until the full impact of the virus is known. There are many out there that is making a fortune on this down turn. There is a huge opportunity to make a lot of money but you have to know when the market is turning around which is where the average investor ends up loosing their shirts.

Brent has it right. At this point, you have to sit it out. Too late to try to sell now. The damage has been down. You don't loose money in the stock market until you sell. Just wait it out.

Of course, this may just be the start. Hopefully it is only the virus and it's impact on production that is guiding the selloff. If the Democrats win big in November, then it will most likely be long term as NO company want to put up with the Democrats tax increases and regulations. They will pack up and move first. With Trumps tax decrease in taxes and regulations, business moved to the US. With the Democrats increases, they will flee.