I don’t blame him for the virus. I am critical of his actions to handle it in some aspects. I think the travel restrictions were good moves. The saying tests are available when they aren’t is just stupid. The briefing he gave at the cdc saying he was so knowledgeable on the topic and his uncle was a genius scientist was laughable. I just hope he gets better about making good decisions and stops trying to make this about him.All short term issues. Remember, we survived the bird flu, swine flu, h1n1 etc, etc. The China flu will be forgotten about soon enough. The only difference now is all the Trump haters are trying to make the China flu about Trump.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Exchanges Diving

- Thread starter BillMasen

- Start date

Help Support Homesteading & Country Living Forum:

This site may earn a commission from merchant affiliate

links, including eBay, Amazon, and others.

I agree this will be a good chance to get some bargains when the economy starts recovering. I just hope it’s not a year before that happens.All short term issues. Remember, we survived the bird flu, swine flu, h1n1 etc, etc. The China flu will be forgotten about soon enough. The only difference now is all the Trump haters are trying to make the China flu about Trump.

I’m glad your so optimistic. I’m looking at Disney closing, sporting events, Broadway, Vegas, cruise lines, airlines and all the peripheral businesses closing down for who knows how long. I don’t believe we are near the bottom yet. That being said, we will get through this and get the world economy going again eventually. There will be a time to buy back in but I don’t see it anytime soon. Hopefully the warmer months will slow the virus but it’s going to be a bad two months at least, maybe more. Once a vaccine and treatment are developed that will make a big difference too, but is at least a year off. I certainly hope this dosent last that long.

Called that one right CBS news live just reported that Disneyland (California) is closing for the remainder of the month.

Stock futures for Friday aren’t looking good either.

Stock futures for Friday aren’t looking good either.

CBSN is broadcasting from Boston because their New York Office is closed for cleaning after 3 employees tested positive.

It Has to be Asked: Are Nefarious Soros-Like Short Sellers Trying to Crash the US Economy?

"It is from short sellers who are using the coronavirus panic to attack the market in an attempt to steal a fortune from Main Street investors. Short sellers do not have to own stock to sell it. They borrow the stock, sell it, and hope to make money by buying back at a lower price. The short sellers are attacking the market by relentlessly borrowing more and more stock and selling it, overwhelming the Main Street buyers."

https://www.thegatewaypundit.com/20...short-sellers-trying-to-crash-the-us-economy/

"It is from short sellers who are using the coronavirus panic to attack the market in an attempt to steal a fortune from Main Street investors. Short sellers do not have to own stock to sell it. They borrow the stock, sell it, and hope to make money by buying back at a lower price. The short sellers are attacking the market by relentlessly borrowing more and more stock and selling it, overwhelming the Main Street buyers."

https://www.thegatewaypundit.com/20...short-sellers-trying-to-crash-the-us-economy/

$19.99 ($10.00 / Count)

$24.99 ($12.50 / Count)

LHKNL Headlamp Flashlight, 1200 Lumen Ultra-Light Bright LED Rechargeable Headlight with White Red Light,2-Pack Waterproof Motion Sensor Head Lamp,8 Mode for Outdoor Camping Running Hiking Fishing

LHKNL HOME

$99.74

$140.99

Augason Farms 30-Day 1-Person Standard Emergency Food Supply Kit, Survival Food, Just Add Water, 200 Servings

Amazon.com

$13.49

$26.99

7 Rules of Self-Reliance: How to Stay Low, Keep Moving, Invest in Yourself, and Own Your Future

Amazon.com

$15.99

$24.99

Relaxed Bible Study Guide plus Streaming Video: Letting Go of Self-Reliance and Trusting God

Amazon.com

$10.69

$16.99

allsun Electric Fence Voltage Tester Fault Finder Farming Equipment Portable Testing Tool Neon Lights Max 600V-7000 V

Global Meter

$19.99 ($6.66 / Count)

AuldHome Design Farmhouse Galvanized Canisters (Set of 3); Storage Containers for Coffee, Tea and Sugar in Galvanized Iron and Wood Design

ClockworkCornucopia

$79.79

$88.15

Primitives by Kathy Rustic Style Canisters, Set of 3, Galvanized Metal and Wood

Amazon.com

$46.50 ($15.50 / Count)

$66.50 ($22.17 / Count)

Kito LIVING Canisters Sets for Kitchen Counter Storage and Organization with Wooden Bamboo Lids, Food Pantry Containers, Stackable Steel Storage Bins, Potato Storage Onion Keeper Garlic - Cream

Variety of Stores

$39.95 ($13.32 / Count)

Red Co. Set of 3 Pre-Labeled Sugar, Coffee & Flour Distressed Metal Storage Canister Jars with Wooden Lids

Red Co Products (US Seller)

$7.50 ($1.88 / Count)

$12.99 ($3.25 / Count)

QIO CHUANG Emergency Mylar Thermal Blankets -Space Blanket Survival kit Camping Blanket (4-Pack). Perfect for Outdoors, Hiking, Survival, Bug Out Bag ,Marathons or First Aid 1

Qio chuang

- Joined

- Mar 29, 2013

- Messages

- 18,405

Didn't Soros wreak the economy in a couple other countries? I think he was quoted that he was going to do the same to the US. This foreign POS should be deported back to Hungary.It Has to be Asked: Are Nefarious Soros-Like Short Sellers Trying to Crash the US Economy?

"It is from short sellers who are using the coronavirus panic to attack the market in an attempt to steal a fortune from Main Street investors. Short sellers do not have to own stock to sell it. They borrow the stock, sell it, and hope to make money by buying back at a lower price. The short sellers are attacking the market by relentlessly borrowing more and more stock and selling it, overwhelming the Main Street buyers."

https://www.thegatewaypundit.com/20...short-sellers-trying-to-crash-the-us-economy/

Yes he did!Didn't Soros wreak the economy in a couple other countries? I think he was quoted that he was going to do the same to the US. This foreign POS should be deported back to Hungary.

But I wouldn’t put it past China doing this

- Joined

- Sep 7, 2013

- Messages

- 18,687

https://priceonomics.com/the-trade-of-the-century-when-george-soros-broke/Didn't Soros wreak the economy in a couple other countries? I think he was quoted that he was going to do the same to the US. This foreign POS should be deported back to Hungary.

In 1992, George Soros brought the Bank of England to its knees. In the process, he pocketed over a billion dollars. Making a billion dollars is by all accounts pretty cool. But demolishing the monetary system of Great Britain in a single day with an elegantly constructed bet against its currency?

According to FOX news China is now trying to blame the US for the corona virus outbreakBut I wouldn’t put it past China doing this

- Joined

- Mar 29, 2013

- Messages

- 18,405

We made China what it is today by buying their cheap crap. Of course Clinton, democrats and weak republicans helped too.But I wouldn’t put it past China doing this

The market had some recovery today from the 2300 point drop yesterday, thankfully. I still wouldn’t want to jump back in just now. We will see how the hit to the economy is after a month of people not going out.

- Joined

- Nov 27, 2015

- Messages

- 10,004

Broke a record today. Upward

It’s these wild swings that are making me pause.Broke a record today. Upward

Making you pause? What do you mean?It’s these wild swings that are making me pause.

Making me stop to think and not get back in the market just now.Making you pause? What do you mean?

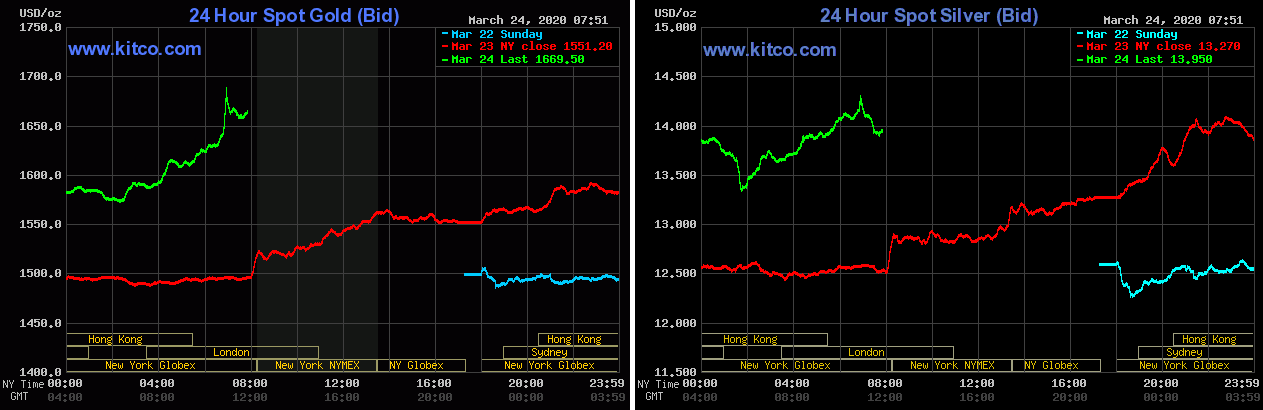

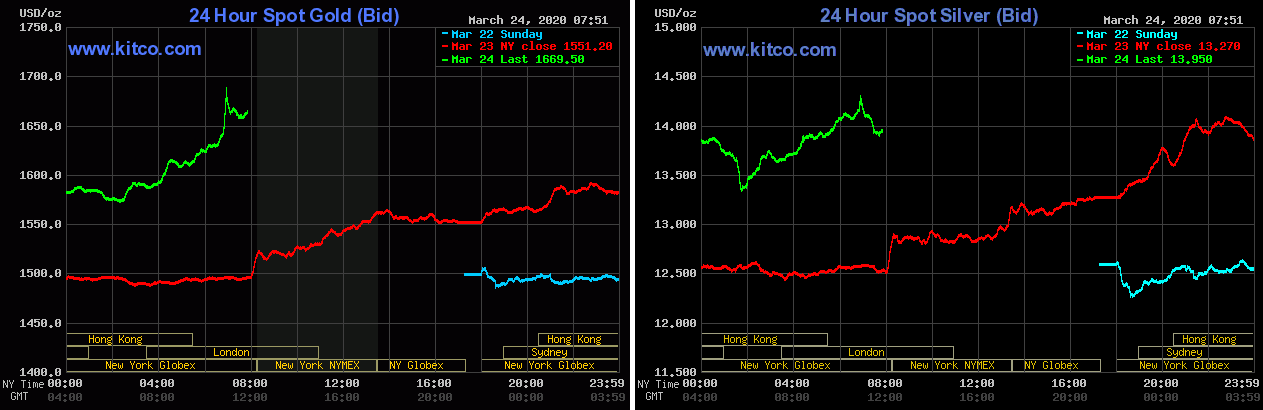

Silver is down right now. Didn’t check yet but believe gold is too. This is nuts to try and predict now.

- Joined

- Oct 25, 2016

- Messages

- 6,474

if you are going to get in you want to do it as close to rock bottom as you can,,,almost every stock will climb back close to where it was it will take a while but almost all will bounce back

All short term issues. Remember, we survived the bird flu, swine flu, h1n1 etc, etc. The China flu will be forgotten about soon enough. The only difference now is all the Trump haters are trying to make the China flu about Trump.

So true. The unbelievable hate and vitriol is unreal. People actually clapping and being glad the Coronavirus is spreading and killing folks. The ones that support our President of course. God is surely shaking his head.

Silver is down right now. Didn’t check yet but believe gold is too. This is nuts to try and predict now.

I saw that. Was considering buying some more. What about you?

- Joined

- Sep 7, 2013

- Messages

- 18,687

I've seen this before. Precious metals going down when they should go up. A lot of people believe it is manipulation of the market through paper gold and silver - ETFs. They are shorting paper gold and silver in an attempt to neuter precious metals as a safe haven. If the precious metals in the market were all physical, this would not happen.

- Joined

- Mar 29, 2013

- Messages

- 18,405

Buy what you can as often you can. It will go up.I saw that. Was considering buying some more. What about you?

I have enough of both silver and gold. I do believe in tangible assets but think being well diversified is smart.I saw that. Was considering buying some more. What about you?

- Joined

- Sep 7, 2013

- Messages

- 18,687

Silver and Gold are headed back up again. Looks like people were desperate for something to invest in.

Last edited:

When the price of gold goes up, that’s a bad sign, correct?

It means people don’t have faith in the economy... or did I dream that? ( very possible).

It means people don’t have faith in the economy... or did I dream that? ( very possible).

- Joined

- Sep 7, 2013

- Messages

- 18,687

They were dumping gold and silver along with everything else a few days ago. I suspect this was people shorting gold and silver ETFs, since you can't exactly short physical metals.

Two days ago was a fantastic buying opportunity, and I think they suddenly realized that and the gold rush began, pulling silver along with it. Silver wasn't doing all that well before, but gold was. Now they are both taking off.

"To da Moon!" as they say in the Kitco gold forum.

I need Silver to go up a couple more dollars and I'll liquidate the Silver ETFs in my Roth IRA, and wait for a buying opportunity in stocks. Great thing about the Roth IRA, no capital gains! I could make a million dollars and not pay a cent in taxes.

Two days ago was a fantastic buying opportunity, and I think they suddenly realized that and the gold rush began, pulling silver along with it. Silver wasn't doing all that well before, but gold was. Now they are both taking off.

"To da Moon!" as they say in the Kitco gold forum.

I need Silver to go up a couple more dollars and I'll liquidate the Silver ETFs in my Roth IRA, and wait for a buying opportunity in stocks. Great thing about the Roth IRA, no capital gains! I could make a million dollars and not pay a cent in taxes.

Last edited:

Normally that’s been the case historically but with the way things are going right now everything is a gamble. The worlds economies are pretty dicey to say the least.When the price of gold goes up, that’s a bad sign, correct?

It means people don’t have faith in the economy... or did I dream that? ( very possible).

- Joined

- Mar 29, 2013

- Messages

- 18,405

Right now, in my opinion, gold is still way too high for me to buy. The last time I bought gold it was under $550 per ounce, and I bought a lot. Plus I owned a placer mine at that time and I still have a lot of fine gold and nuggets. That being said, I would encourage anyone that doesn't currently own gold/silver to buy as much as you can. Just like stocks; buy on the dips.

The economy is important but being impatient to get it going again too soon will devastate our Hospitals https://apple.news/AF9VwAYuyRjiUBpkD6eztkw