I also have some gold notes tooThat is definitely possible...

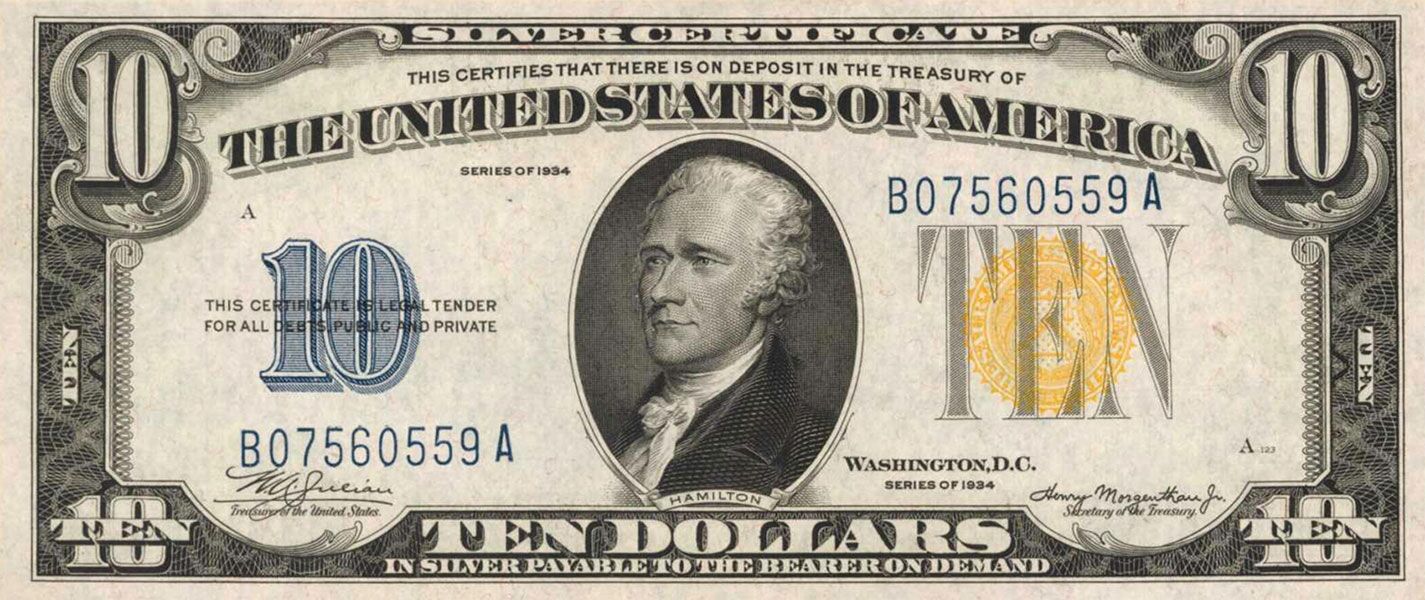

Does anybody besides me remember the "Silver Certificates" currency?

Read the fine print on the bill:

"...Payable to the bearer on demand".

Interesting history read on why they came into existence, and why they went away.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Today, Saturday I just bought a couple grand worth of Silver

- Thread starter Rick

- Start date

Help Support Homesteading & Country Living Forum:

This site may earn a commission from merchant affiliate

links, including eBay, Amazon, and others.

I would LOVE to see just exactly whats in Fort Knox right now!!@angie_nrs got me to thinking, how much gold is in Fort Knox today?

...so, where is the other 43.65% of the government's gold today?

Obama or one of the other nuts probably gave it to Iran

- Joined

- Dec 8, 2017

- Messages

- 8,502

Well, as far as I know Fort Knox doesn't get audited.

The FED doesn't get audited.

The Central Banks don't get audited.

The 3 letter agencies don't get audited.

Lifetime politicians don't get audited.

It seems the only ones who get audited are the taxpayers, not the tax spenders. Is it any wonder our debt is what it is?

We'll never get any answers to anything without auditory transparency. It'll take something pretty big to change the system to make that happen. In the meantime, I trust PM's more than I trust fiat currency.

The FED doesn't get audited.

The Central Banks don't get audited.

The 3 letter agencies don't get audited.

Lifetime politicians don't get audited.

It seems the only ones who get audited are the taxpayers, not the tax spenders. Is it any wonder our debt is what it is?

We'll never get any answers to anything without auditory transparency. It'll take something pretty big to change the system to make that happen. In the meantime, I trust PM's more than I trust fiat currency.

- Joined

- Dec 13, 2017

- Messages

- 1,581

I would do much mro copper if I could but the markups from spot are even worse than for silver.I'm curious as to how many people stock PM's other than Gold an Silver? I have some Platinum, not much. No Pladium. A small bit of copper and of coarse.....some lead (in the form of pew pew's).Although, we have to keep replacing that.

One of the difficult things about copper is that it's value is relatively small in comparison with Gold and Silver. I bought some 5 pound bricks of it several years ago. It certainly takes up more space, but I like to be diversified.

- Joined

- Sep 4, 2020

- Messages

- 10,276

Cut n paste from Jim Rickards

|

- Joined

- Sep 4, 2020

- Messages

- 10,276

I missed the last paragraph of above...Cut n paste from Jim Rickards

RICKARDS

Dear Ben,

In view of market events over the course of today, we’re sending this special report to readers of Strategic Intelligence. We’ll begin with a quick summary of where things stand before turning to the more important topic of where events will go from here.

Where Things Stand:

As of noon today, the Dow Jones Industrial Average Index is down over 800 points or 2.0%. In percentage terms the S&P 500 Index is down 2.1% and the NASDAQ 100 is down 2.4%.

Also, gold is down 0.90% to $2,448 per ounce. Interest rates have plunged, and the dollar index is down about 0.45%. This rout started in Japan while most Americans were asleep but spread around the world with the sun’s rise to China, India, the Middle East and Europe as these things do.

Those moves are all material. You’ve had nice gains if you owned stock puts or Treasury notes and huge losses if you were long stocks. What is happening in New York is nothing compared to what happened in Japan overnight. The Nikkei was down 12.40% in one session after falling last Friday. That’s a crash by any definition.

We’re not at crash levels in the U.S. (yet). Down 2.0% in a day is a big deal, but it bears no comparison to October 1929 when the stock market fell 21% over two days or October 1987 when the stock market fell 21% in one day.

Interestingly, the 1929 crash took 25 years to regain its old high in 1954. The 1987 crash regained its old highs quickly and rallied until the dot.com crash in 2000 with only a mild correction in 1990. Bubbles are easy to spot. Crashes are hard to predict as to timing even when you know they’re coming. But the aftermath of a crash is even harder to predict. That’s OK; that’s our job.

What’s Coming Next:

• This is not the “big one.” A crash of 25% or more in a compressed period of a few weeks (similar to what we saw in March - April 2020) is always possible, but this correction has a dynamic that suggests it will feel for a bottom and then settle down. The “buy the dip” crowd are still around and they will be dipping their toes in the water on a continual basis. That does not mean a sudden rally, but it could mean the market will bounce around the new bottom with those needing cash (or just cautious) getting out and the bottom feeders getting in.

• That said, we may be in for something worse that a crash. We may be in for a long, slow grind to a new bottom that could be down 70% or more from the top (around, say, Dow 12,000). Investors are familiar with the Dow crash of 21% in 1929, but fewer know that the bottom did not come until June 1932 down over 80% from the 1929 high. Something similar happened in the 1970s where the Dow was 1,000 in 1969 and 1,000 in 1982. It went nowhere in 13 years (with some volatility along the way). Adjusted for inflation, the 1982 index was worth less than half the 1969 index, so in real terms you lost over 50% of your wealth over those 13 years before a new bull market began. The problem with a 25-year recovery (1929-1954) or a 13-year recovery (1969-1982) is that some people don’t live that long. Be prepared for that sort of outcome.

• Gold has its own dynamics. Typically, when stocks crash, gold does not rise immediately. Gold goes down because weak hands sell to raise cash to meet margin calls on stock positions or simply to be more liquid. Momentum can take the selling a bit further from there. The strong hands take a beat, look for a new bottom and then jump in aggressively. The result is that gold hits new highs not long after the initial dip. We expect gold to settle comfortably above $2,500 per ounce on its way to $2,750 per ounce and then $3,000 or higher in the months ahead.

• The note and bond market rally is real and will persist. The yield-to-maturity on the benchmark 10-year Treasury note is headed back toward 3.0% with the possibility of a pause or slight back up in September due to hard-to-explain seasonality. By buying Treasuries now, you not only lock in an attractive coupon but you’ll enjoy steady capital gains as yields decline further.

• Here’s what I recently wrote about the prospect of a Federal Reserve rate cut in September: “The best way out for the Fed is to keep their heads down and do nothing. That’s what I expect the Fed to do absent an extreme market meltdown or a sharp spike in unemployment.” Well, we’ve just had the meltdown and spike in quick succession so it’s clear the Fed will cut rates in September. But that’s not a free lunch. My original formulation that the Fed would not cut was based on the fact that inflation was still too high. That’s still true. So, the Fed will be throwing in the towel on inflation in order to calm stock markets. The Fed may end up with the worst of both worlds – continuing inflation and recession known as “stagflation.”

And don’t hold your breath waiting for the “Fed put.” The Fed put is real but it only comes out when stock markets are crashing, say 20% or more in a few weeks or when there’s a bank panic or both. We’re not there yet. It could happen, but the situation right now is not bad enough for the Fed to intervene apart from a 0.25% cut in September. Don’t look for an inter-meeting cut or a 0.50% cut. The Fed doesn’t want you to panic but they don’t want to appear panicky themselves. For now, you’re on your own.

• There’s something much bigger than the markets behind all of this. It’s the economy. We’ve been warning about a recession for a long time – now it’s here. Last Friday’s unemployment report was a sign yet unemployment is a lagging indicator. It means the recession probably began in June or even May. We won’t know for a few more months when the National Bureau of Economic Research makes its unofficial “official” call. This recession could be severe based on excess inventories (that need to be dumped), bull steepeners in the yield curve (bets that short-term rates will drop sharply) and negative swap spreads (signs that credit is tightening and there are collateral shortages). A protracted recession is consistent with our forecast for a long, slow grind down in stocks.

• In the political arena, this stock market action is unquestionably positive for Trump. The Trump campaign was ahead until the switcheroo of Kamala Harris for Biden. After that, Harris had a honeymoon (in the media it was more like a coronation) and the race tightened. With this stock market crash, undecided voters will be reminded of why they didn’t like Biden-Harris in the first place and they will recall happier times under Trump (until COVID hit). We’re still a long way from November 5 but this mini-crash will end the Harris honeymoon and reboot Trump’s mojo.

We’ll be following this story in the weeks ahead and providing extensive detail and analysis in all our publications. For now, cash is king, gold is queen, and Treasury notes are your white knights.

Ben

- Joined

- Dec 8, 2017

- Messages

- 8,502

Good post Ben.....thanks for that.

Are you playing chess??For now, cash is king, gold is queen, and Treasury notes are your white knights.

Ben

- Joined

- Sep 4, 2020

- Messages

- 10,276

Thank you.Good post Ben.....thanks for that.

Are you playing chess??

I get multiple email from Paradigm Press daily. That one seemed timely and worth sharing.

Playing chess?

Chess is all about strategy, planning, and options. Not easy in an environment of greed and fear.

Ben

- Joined

- Dec 8, 2017

- Messages

- 8,502

• Gold has its own dynamics. Typically, when stocks crash, gold does not rise immediately. Gold goes down because weak hands sell to raise cash to meet margin calls on stock positions or simply to be more liquid. Momentum can take the selling a bit further from there. The strong hands take a beat, look for a new bottom and then jump in aggressively. The result is that gold hits new highs not long after the initial dip. We expect gold to settle comfortably above $2,500 per ounce on its way to $2,750 per ounce and then $3,000 or higher in the months ahead.

_____________________________________________________________________________________________

That part above makes a lot of sense to me. The big fund managers will need to pivot and that can take some time. It'll be interesting to see where Gold and Silver settle at the end of the year. No matter who is appointed at the election, I think the markets will be shaky. I think if we truly had a free market, things wouldn't be so volitile. However, TPTB know how to make money off the volitile markets......in fact, that is where most money is made. They LOVE volitility with the big dips one way or the other over a short period of time, especially when they know which way those dips will go.

It seems there are murmurs of our IRA's being on the chopping block from Uncle Sam. That is really the last storage of wealth that the govt' can invade, especially when the housing bubble bursts. What do you think will happen when all of a sudden Uncle Sam says....."hey, sorry but we need to take this in order to fight another war that you don't want." Anything that is in a digital form (account) would be fair game to them. Can you imagine the uproar of the citizens? They have already taxed the hell out of Americans and they have the highest CC debt ever. There's nowhere else they can turn if they want to decimate the middle class since many of them really don't own much of anything else.

If my IRA gets confiscated, I will be pizzed....but I have other means of savings. Being diversified at a time like this would be a good idea b/c there isn't just ONE way to financially prepare for the future. I really like having the feeling of security in having an IRA, but I'm not crazy enough to depend upon that completely b/c it will have strings attached even if the govt' doesn't create another way to invade it.

_____________________________________________________________________________________________

That part above makes a lot of sense to me. The big fund managers will need to pivot and that can take some time. It'll be interesting to see where Gold and Silver settle at the end of the year. No matter who is appointed at the election, I think the markets will be shaky. I think if we truly had a free market, things wouldn't be so volitile. However, TPTB know how to make money off the volitile markets......in fact, that is where most money is made. They LOVE volitility with the big dips one way or the other over a short period of time, especially when they know which way those dips will go.

It seems there are murmurs of our IRA's being on the chopping block from Uncle Sam. That is really the last storage of wealth that the govt' can invade, especially when the housing bubble bursts. What do you think will happen when all of a sudden Uncle Sam says....."hey, sorry but we need to take this in order to fight another war that you don't want." Anything that is in a digital form (account) would be fair game to them. Can you imagine the uproar of the citizens? They have already taxed the hell out of Americans and they have the highest CC debt ever. There's nowhere else they can turn if they want to decimate the middle class since many of them really don't own much of anything else.

If my IRA gets confiscated, I will be pizzed....but I have other means of savings. Being diversified at a time like this would be a good idea b/c there isn't just ONE way to financially prepare for the future. I really like having the feeling of security in having an IRA, but I'm not crazy enough to depend upon that completely b/c it will have strings attached even if the govt' doesn't create another way to invade it.

I saw this happen in 2008-2009. I remember there being a delay in gold rising, and wondering about why there was a delay. Apparently the traders try to stay liquid for a while before they lock into gold.Cut n paste from Jim Rickards

• Gold has its own dynamics. Typically, when stocks crash, gold does not rise immediately. Gold goes down because weak hands sell to raise cash to meet margin calls on stock positions or simply to be more liquid. Momentum can take the selling a bit further from there. The strong hands take a beat, look for a new bottom and then jump in aggressively. The result is that gold hits new highs not long after the initial dip.

Gold hit $2500 today for the first time.... did anybody notice?I saw this happen in 2008-2009. I remember there being a delay in gold rising, and wondering about why there was a delay. Apparently the traders try to stay liquid for a while before they lock into gold.

3-year graph:

Collectors should be celebrating.

Last edited:

- Joined

- Sep 4, 2020

- Messages

- 10,276

Not where I watch the price.Gold hit $2500 today for the first time.... did anybody notice?

https://goldprice.org/gold-price-usa.html

Ben

Marketwatch shows it at 2502

Not tracking much of anything since Friday nightGold hit $2500 today for the first time.... did anybody notice?

- Joined

- Mar 29, 2013

- Messages

- 16,080

Yep. I check the price of gold every day. I've been selling off a little gold over the last year or so. Just taking some profits.Gold hit $2500 today for the first time.... did anybody notice?

I think their graph only shows their "buy it from you" price.

Everything they sell is $100 or more over that.

- Joined

- Mar 29, 2013

- Messages

- 16,080

Gold is up over $38 and the Dow is up 1.4% this morning. We're all making money now. Just wish I knew how to do a happy dance.

It was just a few short days ago that many people thought the stock market was going to crash, just because it had a little correction.

It was just a few short days ago that many people thought the stock market was going to crash, just because it had a little correction.

- Joined

- Mar 29, 2013

- Messages

- 16,080

Gold went up another $58 an ounce, the Dow is up to 40,659. Will the markets go down again? Of course they will, possibly substantially. To me, a big drop just means a good buying opportunity. The only negative that I see is that oil is getting close to $80 a barrel. That price will probably triple at least if the commies manage to keep the WH.

- Joined

- Sep 4, 2020

- Messages

- 10,276

Yup.Gold went up another $58 an ounce, the Dow is up to 40,659. Will the markets go down again? Of course they will, possibly substantially. To me, a big drop just means a good buying opportunity. The only negative that I see is that oil is getting close to $80 a barrel. That price will probably triple at least if the commies manage to keep the WH.

Above $2500 an oz with some saying $3k is only a 20% increase.

Inflation

Ben

- Joined

- Sep 4, 2020

- Messages

- 10,276

Samsung solid-state battery uses silver.

https://kitco.com/news/article/2024...ngs-solid-state-battery-breakthrough-analysts

Double the energy of current batteries.

Charge much faster.

Ben

https://kitco.com/news/article/2024...ngs-solid-state-battery-breakthrough-analysts

Double the energy of current batteries.

Charge much faster.

Ben

That'll drive Silver higher.

Wow! A 9-minute charge time?Samsung solid-state battery uses silver.

https://kitco.com/news/article/2024...ngs-solid-state-battery-breakthrough-analysts

Double the energy of current batteries.

Charge much faster.

Ben

Keep talking, you got my attention!

Bambrough said. “Samsung's new solid-state battery technology, incorporating a silver-carbon (Ag-C) composite layer for the anode, exemplifies this advancement. Silver's exceptional electrical conductivity and stability are leveraged to enhance battery performance and durability, achieving amazing benchmarks like a 600-mile range and a 20-year lifespan and 9-minute charge.”

- Joined

- Sep 4, 2020

- Messages

- 10,276

I thought you would like that article.Wow! A 9-minute charge time?

Keep talking, you got my attention!

Ben

Funnily enough, there were articles a few years ago here that Germany and a few other EU countries asked for some of their gold back, and were told 'no'. They also were not allowed to see it? Makes you wonder.I would LOVE to see just exactly whats in Fort Knox right now!!