Do as much in as many areas as relate to your situation and you can affordThere many events to prepare for. Only in some of them will people refuse gold as being worthless.

Diversity in prepping is not a bad thing.

Last edited:

Do as much in as many areas as relate to your situation and you can affordThere many events to prepare for. Only in some of them will people refuse gold as being worthless.

Diversity in prepping is not a bad thing.

I'm a societal collapse prepper and survivalist.There many events to prepare for. Only in some of them will people refuse gold as being worthless.

Diversity in prepping is not a bad thing.

At 20 bux and change, it looks pretty dang tasty!I'm so tempted to pull the trigger on silver today.

I would much rather have shiny coins or bars than jewelry. I know, I'm a freak.

I would much rather have shiny coins or bars than jewelry. I know, I'm a freak.But they don't have pretty colors!Oh, how I love those shiny things!I would much rather have shiny coins or bars than jewelry. I know, I'm a freak.

With Ukraine robbing us of billions per day now (it seems), those dollars are getting more useless by the day. It's just not sustainable and those coins are going to be backing a new currency sooner rather than later. I want to be ready......

Just when I think I'm all topped off on PM's.......a good deal comes along.

(sarcasm)

(sarcasm)

Well, I won't get into 'nickel & dimes' (pun) but if anyone payed attention to my post about silver being "tasty" on 02-27, they would be sitting on a %10 gain today:Hmmm.....I wonder if Fort Knox might be in the spotlight soon?

View attachment 105718View attachment 105717

Gold is right at $2K now and it ain't headed downWith the recent bank failure scare, the potential for hyperinflation right at our doorstep, and global unrest, I'm thinking the price of PM's will continue to increase. I think there may be a discounted buy in the near future. When the housing market bubble implodes and drags the entire market down with it (including PM's) there may be another window in which to get in at a discount.

Yeah, they've been headed upwards the last few weeks or so. I think people are nervous and want to invest in a sure thing. My PM portfolio is happy. But, as we all know......things can change. PM's are still not at their all time high....but getting close.Gold is right at $2K now and it ain't headed down.

Silver seems to have stabilized at $22 and change.

I look around here and it looks like everyone is doing very well financially. It seems that everyone has a new or newer RV, at least 2 ATV's and or side by sides, new pickup trucks, and new boats. Real estate prices are ridiculously high, but there always seems to be a buyer, and very little is priced under a million $$. From what I can see it appears that the economy is doing very well. The high price of fuel hasn't stopped anyone from driving their RVs, many of which are from out of state. Everywhere I go there are Help Wanted signs. It sure doesn't look anything like the doom and gloom that I keep hearing about on TV. I guess that all the new trucks, SUVs, RVs, ATV's, boats, etc are financed. With the amount of jobs available, it seems that people can afford to finance these things.Bidenomics.......Inflation and deflation at the same time. Yep, sounds about right.

The inflation is hitting the middle class hard with increased costs of food, fuel, and everything else. They have to sell their stuff to put more $$ towards regular things that cost way more than they used to. That is unsustainable and it's going to bust wide open. We're not there yet though, at least not in my area. Homes and land are still selling for wayyy over asking price here. I hate that b/c it raises my taxes.....as if we aren't all taxed to death already!

I'll be waiting for deals when folks decide to sell. I've gotten some deals recently, but those were due to either estate sales secondary to deaths OR idiots that took on too much debt for stupid stuff and now have to sell other things to pay the monthly payments. It probably won't be long before they have to sell their 'stupid' stuff at a huge discount just to pay the house bills. Some people will never learn......

It looks like PM's have stayed relatively steady the last several months.

How would the government even know you have silver in any form? I've been buying and selling gold and silver for over 40 years. Never had a record of any sales or purchases.I keep saying it, but nobody believes me, if it was made by the US government, it is subject to confiscation because it is their property. If you go for regular coins, make sure they are Canadian Dollars or Mexican Pesos. I think Germany still uses a 50% silver Mark. if you got junk with no numismatic or collector value, melt it down into 1oz bars while you can and mix in a little electronics salvage so it is no longer coin grade.

What are steel pennies worth?

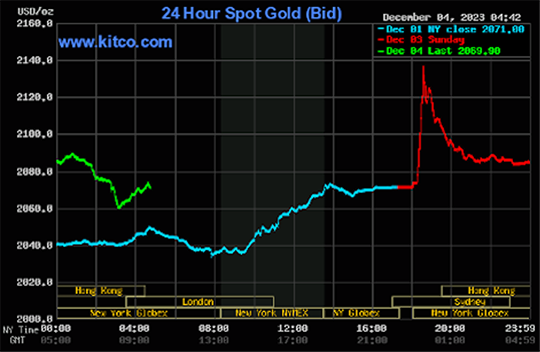

Here’s the spot gold chart for this morning… | |

| |

Source: Kitco | |

“Let’s start with Friday’s light blue line. We saw nice price movement from about $2,040 to the close of $2,071. “Then we go into Sunday’s market (the red line),” Sean says. “Spot gold spiked to nearly $2,150, a tremendous $100 move over little more than a day. |

Yes. And if @angie_nrs followed my bad 'non-advice' on silver back in February, she is up a little over 20% in just 10-months.Cut n paste from Jim Rickards email.

"

"

“Then we go into Sunday’s market (the red line),” Sean says. “Spot gold spiked to nearly $2,150, a tremendous $100 move over little more than a day.

It was interesting watching gold price last night.

Ben

Not quite yet.Yes...

Silver at $24.89 today.

If anybody has been playing along, they will notice that PM's nicely counterbalance inflation.

One theory is that gold never changes that much. The dollar fluctuates. When you were spending $250/oz for gold that same $250 could buy X. That same X today would cost you around $2,000. When the Dollar is no longer the reserve currency, good luck finding gold or silver anywhere near today's prices. PM's are a hedge, You never make anything, you prevent a loss.I don't think we'll ever see any of the astronomical prices for gold as some are predicting, at least not in our lifetimes. But then when I was buying gold for around $250/oz, I never thought it would reach $2000 either. In my opinion gold is too high right now to invest in. However, if you think it will double or triple, then gold is a bargain. For my money, I think silver is a better buy right now at $22.82.

I believe everyone should hold at least 25% of their net worth in PM's. Of course this is just my opinion which is worth less nothing.

This is correct. They do not pay a dividend, but....One theory is that gold never changes that much. The dollar fluctuates. When you were spending $250/oz for gold that same $250 could buy X. That same X today would cost you around $2,000. When the Dollar is no longer the reserve currency, good luck finding gold or silver anywhere near today's prices. PM's are a hedge, You never make anything, you prevent a loss.

If you switch to a longer time frame the values plotted are month end.View attachment 120803View attachment 120802

Goldprice.org has both. You can change the duration - 1 day, 6 months, a year, whatever. I did 7 days to catch month's end.

Ben - interesting on the gold not ending a month on high.