So pretty much all my wealth is a machine's imagination. maybe if I get it drunk, it'll imagine I'm rich long enough to buy an SUV full of dehydrated food and ammo!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Today, Saturday I just bought a couple grand worth of Silver

- Thread starter Rick

- Start date

Help Support Homesteading & Country Living Forum:

This site may earn a commission from merchant affiliate

links, including eBay, Amazon, and others.

I kinda like mine.Along the same lines, now we have the E-dollar.

It's just as worthless as a real dollar, but now weighs nothing!

I have one piece of plastic that says I have $26,200 that some company says I can spend

Sorry, now back on topic, talking about stuff that has real value.

Last edited:

Gold got up to $2,454 today and closed at $2,430.

(Notice the 52-week range, and day range ):

):

I think it may be on the move up.

(Notice the 52-week range, and day range

I think it may be on the move up.

- Joined

- Sep 4, 2020

- Messages

- 10,276

Silver has doubled or tripled gold's gain in the last couple of days.Gold got up to $2,454 today and closed at $2,430.

(Notice the 52-week range, and day range):

View attachment 130392

I think it may be on the move up.

The wife reminds me daily.

Ben

- Joined

- Dec 13, 2017

- Messages

- 1,581

Gains in Silver are just amazing.

I am glad I bought it when I did.

Gold had a lot of gains too but it really just about beats inflation.

I if it isnt people like us who are driving silver up, since the demand from folks who have lost confidence in fiat currencies is clearly as high as never before.

I am glad I bought it when I did.

Gold had a lot of gains too but it really just about beats inflation.

I if it isnt people like us who are driving silver up, since the demand from folks who have lost confidence in fiat currencies is clearly as high as never before.

- Joined

- Sep 4, 2020

- Messages

- 10,276

Same here with hard stuff on hand. The gold and silver in trusts will be sold to take profit when the price right.I will not sale my Gold & silver until the frig is empty.

My children can cash it in when I am gone.

Ben

- Joined

- Dec 8, 2017

- Messages

- 8,502

Good to see you back Rick!Gains in Silver are just amazing.

I am glad I bought it when I did.

Gold had a lot of gains too but it really just about beats inflation.

I if it isnt people like us who are driving silver up, since the demand from folks who have lost confidence in fiat currencies is clearly as high as never before.

This has been a great thread

I will not sale my Gold & silver until the frig is empty.

My children can cash it in when I am gone.

We feel the same way. God forbid things ever get bad enough that we have to use it. It will be there as a legacy for the kids and the grandkids.

I'm not big on the idea of buying gold or silver because I tried that once & lost. However I am big on listening to my wife & pleasing her & she told me that we should buy some silver. I went to the place where my neighbor buys silver & had them take down my name & number. They don't have any on hand now but will call me when they get some in. I'll buy a couple of thousand dollars worth & then see if she wants me to buy more (or if it's a whim).

Things got that bad for me once…. used up some resources. Given my track record… it’ll happen again. Still, I’ve made it this far and still doing alright. Now I have other things to fall back on, if bad goes to worst.We feel the same way. God forbid things ever get bad enough that we have to use it. It will be there as a legacy for the kids and the grandkids.

- Joined

- Jul 30, 2023

- Messages

- 9

my rationale for storing silver coins:Mercury dimes are good to have, might just be enough for a loaf of bread some day.

one silver dime in 1900, 2024, 2099 will buy a can of corn.

- Joined

- Dec 13, 2017

- Messages

- 1,581

Good to see you back Rick!

This has been a great thread

Thank you for the kind words

- Joined

- Dec 8, 2017

- Messages

- 8,502

I signed up for alerts from the US mint to notify me when the 2024 silver proof sets were available for purchase. I got a notification on 6/27 that the sets were $130. I went to go and order them 2 days ago and now they are $150. I want to buy a couple of them for gifts, but dang.....

May 20th was $32.45 for the silver high of this year. It's $31.62 now. It looks like a support line to me. If that's the case, then it could be set to jump even higher than the May 20th high of the year. Plus, as we see banks feeling pressures, I think more people will be moving toward PM's. I'm not sure where this is going, but I'd bet the PM's will be more valuable at the end of 2024.

May 20th was $32.45 for the silver high of this year. It's $31.62 now. It looks like a support line to me. If that's the case, then it could be set to jump even higher than the May 20th high of the year. Plus, as we see banks feeling pressures, I think more people will be moving toward PM's. I'm not sure where this is going, but I'd bet the PM's will be more valuable at the end of 2024.

- Joined

- Dec 13, 2017

- Messages

- 1,581

With spot prices this high and markups even higher I no longer have a "buy" postion.

I dont engage in any profit taking via selling either but it has outperformaed inflation by a significant margin, so that might not be an unreasonable course of action, especially if followed by a conversion to Gold or Platinum.

As for myself I am at "hold", not "buy" now, when it comes to Silver.

I dont engage in any profit taking via selling either but it has outperformaed inflation by a significant margin, so that might not be an unreasonable course of action, especially if followed by a conversion to Gold or Platinum.

As for myself I am at "hold", not "buy" now, when it comes to Silver.

- Joined

- Dec 4, 2017

- Messages

- 7,872

I too am in a hold position. It's like ammo. Buy it and sit on it... the day will come when you need it.

I've been dabbling with individual stocks that took a beating this week. Stocks that dipped down 20%+ so I bought at a low. Waiting to see how it plays out.

I've been dabbling with individual stocks that took a beating this week. Stocks that dipped down 20%+ so I bought at a low. Waiting to see how it plays out.

- Joined

- Dec 8, 2017

- Messages

- 8,502

Yeah, I still think PM's have room to move up. I think our dollar is going to face hyperinflationary pressures very soon. Our debt clock seems to have just run amuck. We have definitely passed the tipping point.....just waiting for the glass container to hit the deck and shatter. I feel that is where we are right now.With spot prices this high and markups even higher I no longer have a "buy" postion.

I dont engage in any profit taking via selling either but it has outperformaed inflation by a significant margin, so that might not be an unreasonable course of action, especially if followed by a conversion to Gold or Platinum.

As for myself I am at "hold", not "buy" now, when it comes to Silver.

I am a buyer, not a seller. Ha.....we don't sell much of anything. The exception would be a boat that we bought a couple of years ago at a discount. We used it ONE time and it was taking up valuable storage space so we sold that for a nice profit this spring. I re-invested that money into gold. It takes up a lot less space and requires much less maintenance! Even buying Gold when I did, I'm still seeing a profit. But, I'm not selling so it's not really a factor. We don't need the cash right now, so I thought putting it into PM's was a good move.

I also agree with you Zoom. I went to a store last week and just happened to walk by the ammo counter. I wasn't really planning on buying anything, but I picked up 4 boxes anyways. The price was good and it was on the shelf. I thought it looked better than the cash in my wallet, so it came home with me. A year or two ago in my area, stores were out of the deer rifle ammo my husband prefers. He has some at home but we shouldn't have to worry about that again........ever. LOL!

Last edited:

I'm glad that my wife doesn't read these posts. A month are so ago I left my name for them to call me when they got silver in (at my wife's direction). She was up there & happened to ask about it & bought 15 oz of silver. If she knew it went up she wouldn't SAY ANYTHING. Nope, she would just give me THAT LOOK.Silver has doubled or tripled gold's gain in the last couple of days.

The wife reminds me daily.

Ben

- Joined

- Dec 8, 2017

- Messages

- 8,502

I'm curious as to how many people stock PM's other than Gold an Silver? I have some Platinum, not much. No Pladium. A small bit of copper and of coarse.....some lead (in the form of pew pew's). Although, we have to keep replacing that.

Although, we have to keep replacing that.

One of the difficult things about copper is that it's value is relatively small in comparison with Gold and Silver. I bought some 5 pound bricks of it several years ago. It certainly takes up more space, but I like to be diversified.

One of the difficult things about copper is that it's value is relatively small in comparison with Gold and Silver. I bought some 5 pound bricks of it several years ago. It certainly takes up more space, but I like to be diversified.

I started with silver. Collected it almost weekly for a while, getting very aggressive cutting my weekly spending on fast food and alcohol and whatnot. I put a fair amount of cash into silver, by getting tiny bits, here and there.I'm curious as to how many people stock PM's other than Gold an Silver? I have some Platinum, not much. No Pladium. ... [Copper] certainly takes up more space, but I like to be diversified.

Going to the local coin shop almost weekly helped me become a "regular" there, so they would see me coming.

Then I read online that if could learn the discipline enough to hold onto cash, and then buy a tube of silver, I would be really satisfied, and really up my metals game. It worked. I loved the feel of that much silver...very hefty. I started saving more and more.

But, frankly, that was heavy enough for me. I was moving a bag of it one day, after cataloging it, and it was pretty heavy. So, I never went down to copper. Instead, I went up to gold.

I gave platinum some thought, especially as it came down in relation to gold. But, a lot of what I was saving for was for economic collapse, and possible lack of electricity/internet (and therefore a loss of ability by potential buyers to do research), so I decided to focus on coins that would be the most recognizable among my likely buyers...and with the longest history (thousands of years) of being currency. Gold is both a great store of wealth per weight, and is most recognizable (and therefore most trustworthy by less informed people). And, if platinum retained its value, then I figured so would gold. So, I stuck with gold.

Last edited:

I forgot to mention: Although I never bought physical platinum, I have bought into a platinum based fund with my digital savings. So, not physical platinum, but I diversified a bit (and hedged against collapse) with digital wealth.

Think about titainium bricks tooI'm curious as to how many people stock PM's other than Gold an Silver? I have some Platinum, not much. No Pladium. A small bit of copper and of coarse.....some lead (in the form of pew pew's).Although, we have to keep replacing that.

One of the difficult things about copper is that it's value is relatively small in comparison with Gold and Silver. I bought some 5 pound bricks of it several years ago. It certainly takes up more space, but I like to be diversified.

GOLD is way to high to buy now!I started with silver. Collected it almost weekly for a while, getting very aggressive cutting my weekly spending on fast food and alcohol and whatnot. I put a fair amount of cash into silver, by getting tiny bits, here and there.

Going to the local coin shop almost weekly helped me become a "regular" there, so they would see me coming.

Then I read online that if could learn the discipline enough to hold onto cash, and then buy a tube of silver, I would be really satisfied, and really up my metals game. It worked. I loved the feel of that much silver...very hefty. I started saving more and more.

But, frankly, that was heavy enough for me. I was moving a bag of it one day, after cataloging it, and it was pretty heavy. So, I never went down to copper. Instead, I went up to gold.

I gave platinum some thought, especially as it came down in relation to gold. But, a lot of what I was saving for was for economic collapse, and possible lack of electricity/internet (and therefore a loss of ability by potential buyers to do research), so I decided to focus on coins that would be the most recognizable among my likely buyers...and with the longest history (thousands of years) of being currency. Gold is both a great store of wealth per weight, and is most recognizable (and therefore most trustworthy by less informed people). And, if platinum retained its value, then I figured so would gold. So, I stuck with gold.

- Joined

- Dec 8, 2017

- Messages

- 8,502

I guess that depends on what happens next. If (that's a big IF) American currency is once again tied back to the Gold standard after an economic collapse, then Gold would still be a good buy now b/c our dollars we have today would be useless. IF you took at it that way, PM's are all a good buy right now.GOLD is way to high to buy now!

I just don't see how America can recover from the debt we have dug ourselves in to. That's why I'd still be a buyer. Our dollar won't hold up, but PM's (and other assets) likely will.

I did stop buying because "gold is high."GOLD is way to high to buy now!

But, I do wonder if I still should be buying more.

Gold is high in relation to the dollar...so gold is high because the value of the dollar is low (because the dollar is "inflated"...leave it to economists to use a word like "inflated" for something that has decreased in value)...and what are the odds that the dollar will increase in value? If the dollar is on a steady downward trend in value (steady inflation), then gold will not come down, so it is still a potential buy...unless you have enough gold, and you decide to put your wealth in other media.

Not sure what "enough gold" is.

As for me, I am old enough now, and I've worked hard on my finances over time, that I'm now putting some of my wealth into personal experiences. Travel, good food, etc. Those are high now as well, though.

That is definitely possible...I guess that depends on what happens next. If (that's a big IF) American currency is once again tied back to the Gold standard after an economic collapse, then Gold would still be a good buy now b/c our dollars we have today would be useless. IF you took at it that way, PM's are all a good buy right now.

I just don't see how America can recover from the debt we have dug ourselves in to. That's why I'd still be a buyer. Our dollar won't hold up, but PM's (and other assets) likely will.

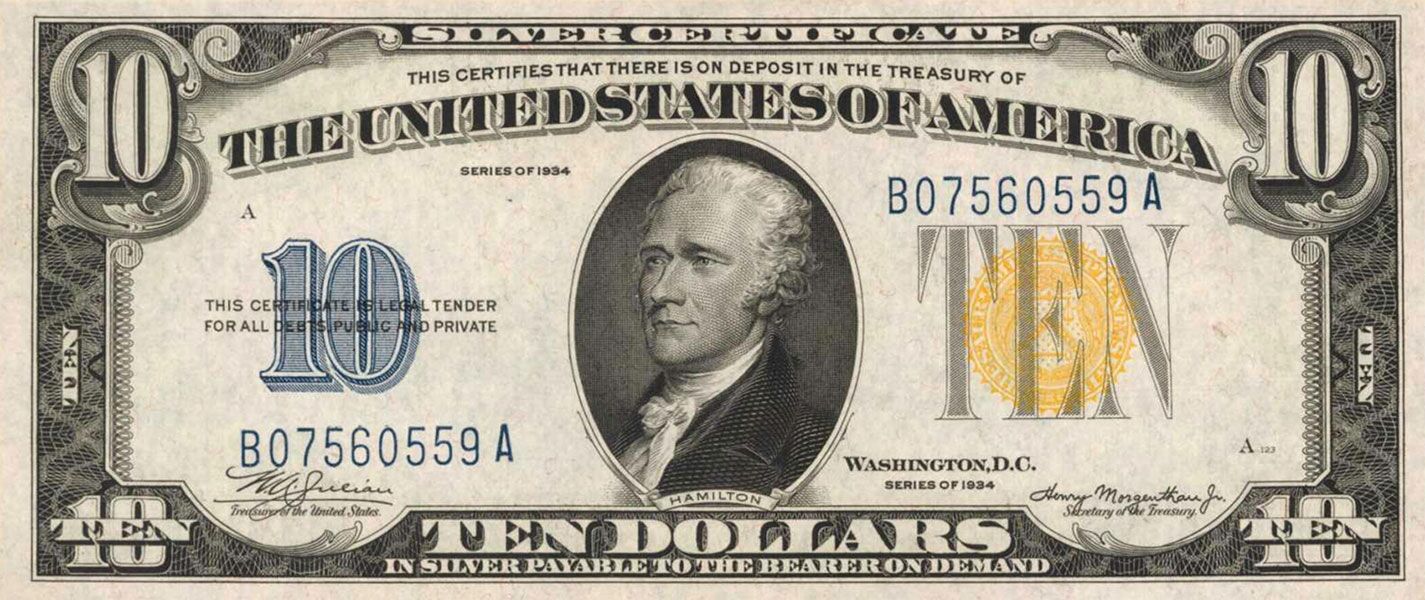

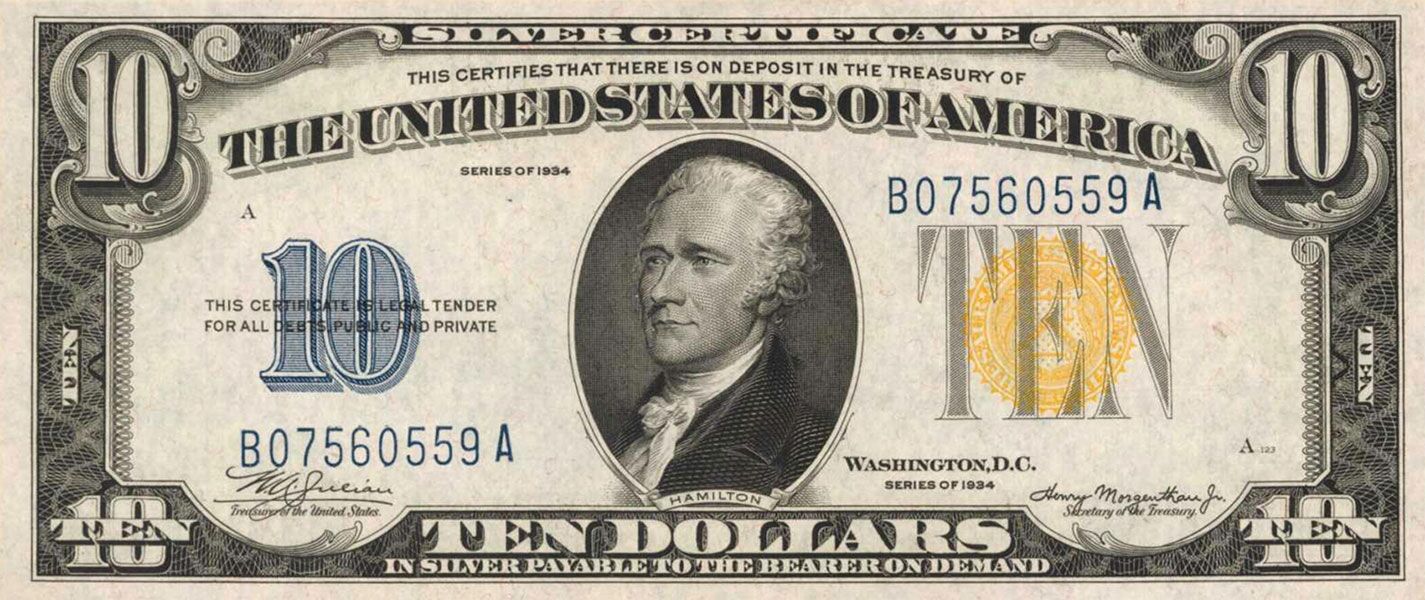

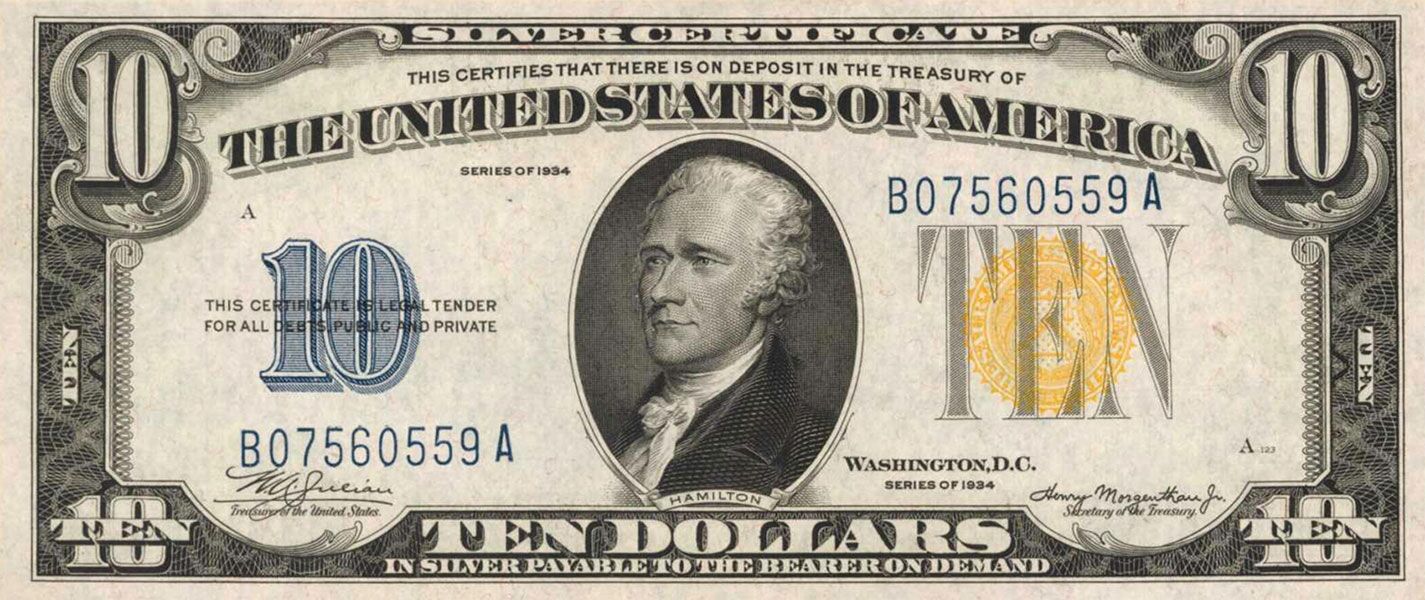

Does anybody besides me remember the "Silver Certificates" currency?

Read the fine print on the bill:

"...Payable to the bearer on demand".

Interesting history read on why they came into existence, and why they went away.

Last edited:

A silver certificate is a type of legal tender in the form of paper currency that was issued by the U.S. government beginning in 1878. These certificates were eventually phased out in 1964 and today can be redeemed for their face value in cash only, rather than in actual silver.That is definitely possible...

Does anybody besides me remember the "Silver Certificate" currency?

Read the fine print on the bill:

"...Payable to the bearer on demand"

Well darn!

@angie_nrs got me to thinking, how much gold is in Fort Knox today?

...so, where is the other 43.65% of the government's gold today?As of February 2023, the United States Bullion Depository at Fort Knox, Kentucky, had 147.3 million ounces of gold in storage. This is about half of the gold stored by the U.S. Treasury and represents 56.35% of the country's gold reserves. At the current price of gold, this amount is worth over $290 billion.

$2,383.70/oz (today) x 147,300,000 oz = $351,119,010,000

$61 Billion "appreciation" in a little over a year...that's pretty nice!

The remaining 43.65% might be inside of an old car inside someone's Delaware garage or in a box in some Florida bathroom? Or maybe it's somewhere in the depths of a 6400 sq ft home in the Illinois suburb of Kenwood, close to Chicago?

$61 Billion "appreciation" in a little over a year...that's pretty nice!

The remaining 43.65% might be inside of an old car inside someone's Delaware garage or in a box in some Florida bathroom? Or maybe it's somewhere in the depths of a 6400 sq ft home in the Illinois suburb of Kenwood, close to Chicago?

I have a few of those my mamaw gave me. Perfect conditionThat is definitely possible...

Does anybody besides me remember the "Silver Certificates" currency?

Read the fine print on the bill:

"...Payable to the bearer on demand".

Interesting history read on why they came into existence, and why they went away.