Sorry Jay! What a jerk! Hope she finds the strength to leave someday!Sad day today for me. Went to wall mart to do my monthly shopping, and behind me was a couple at check out lane. He was loud and seemed to be loudly complaining about everything. His wife, I think, reached over and grabbed a pack of gum off the rack there and started putting it in their small cart. He demanded that she put it back, and continued to criticize her and belittle her in front of everyone at the store. I have never seen mental abuse before, only heard of it, but anyway, while he was paying for the stuff, she looked at me and our eyes met for a moment, and it was as if she had been suffering this abuse for a long time. I have seen this look in the eyes of dogs that have had a lifetime of abuse. This is still bothering me even after a few hours here at home, and knowing there was nothing I could do to stop it, without ending up in jail myself.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Rant for the Day (keep it clean)

- Thread starter phideaux

- Start date

Help Support Homesteading & Country Living Forum:

This site may earn a commission from merchant affiliate

links, including eBay, Amazon, and others.

- Joined

- Dec 3, 2017

- Messages

- 23,678

Sounds like a narcissist. I steer clear from those types as much as I can. But we have two in our family at the moment that I'm stuck with, and thankfully I don't rely on them like this lady relies on her husband.

You know, I heard this story years ago about a guy like him, his own kid mixed LSD and DMSO and swabbed his door handle on his truck with it.

Fortunately nobody died, but he got to spend a week at the loon farm for waving his pants over his head standing on his truck screaming "I AM JESUS!"

Fortunately nobody died, but he got to spend a week at the loon farm for waving his pants over his head standing on his truck screaming "I AM JESUS!"

.. his own kid mixed LSD and DMSO and swabbed his door handle on his truck with it...

Kudos to One Smart Kid..

jd

Near as I can gather from casual reading, the guy may be a sociopath, or may just not have been raised right. Narcissism is one attribute of that condition. I think.Sounds like a narcissist. I steer clear from those types as much as I can. But we have two in our family at the moment that I'm stuck with, and thankfully I don't rely on them like this lady relies on her husband.

$15.99

$24.99

Relaxed Bible Study Guide plus Streaming Video: Letting Go of Self-Reliance and Trusting God

Amazon.com

$10.69

$16.99

allsun Electric Fence Voltage Tester Fault Finder Farming Equipment Portable Testing Tool Neon Lights Max 600V-7000 V

Global Meter

$13.49

$26.99

7 Rules of Self-Reliance: How to Stay Low, Keep Moving, Invest in Yourself, and Own Your Future

Amazon.com

$46.50 ($15.50 / Count)

$66.50 ($22.17 / Count)

Kito LIVING Canisters Sets for Kitchen Counter Storage and Organization with Wooden Bamboo Lids, Food Pantry Containers, Stackable Steel Storage Bins, Potato Storage Onion Keeper Garlic - Cream

Variety of Stores

$34.95 ($8.74 / Count)

$49.95 ($12.49 / Count)

Barnyard Designs White Canister Sets for Kitchen Counter, Vintage Kitchen Canisters, Country Rustic Farmhouse Decor for the Kitchen, Coffee Tea Sugar Flour Farmhouse Kitchen Decor, Metal, Set of 4

Barnyard Designs USA

$7.50 ($1.88 / Count)

$12.99 ($3.25 / Count)

QIO CHUANG Emergency Mylar Thermal Blankets -Space Blanket Survival kit Camping Blanket (4-Pack). Perfect for Outdoors, Hiking, Survival, Bug Out Bag ,Marathons or First Aid 1

Qio chuang

$99.74

$140.99

Augason Farms 30-Day 1-Person Standard Emergency Food Supply Kit, Survival Food, Just Add Water, 200 Servings

Amazon.com

- Joined

- Dec 3, 2017

- Messages

- 23,678

Yep. Poor lady having to put up with him. Hoping she can escape.

- Joined

- Feb 12, 2020

- Messages

- 4,302

Havasu, I'm very sorry to hear about your gf's bff. It sucks that her family members weren't able to say goodbye to her. That can't have felt good for anyone.

Internet is being very slow tonight-- this site in particilar. It's not letting me use reactions to posts and I had trouble loading the main page. I clicked a reaction 5 minutes ago and it still shows a loading bar.

Ok, reloaded and its working now. Sheesh.

Jay, that reminds me of the time I was in Walmart and some man was berating his wife, calling her stupid, & even grabbed her by the arm and yanked her away & threatened her. I went into ragemode and got up in his face (this was years ago), called him an a-hole and told him to knock off the domestic violene before he got knocked on his a$$. He looked totally shocked. The woman was crying but she quietly thanked me. I do not tolerate that kind of bs.

I had a visit from someone who used to work with my father. She wasn't coming to visit us, she & her family wanted to see the house & yard because a relative had just died & they apparently used to live here (owned it before the people who sold the place to us did). For one, it was a reminder that my father is gone, also learned that it was one of my nicer neighborhood people who died, and I felt sad that the place was in such bad condition. Busted up car port, knocked down front gate, broken fences, barn is falling apart, house exterior needs to be pressure washed-- junk all over the porch, a ding on the edge of the roof over the porch... I wanted them to see it in better condition. We did reminisce about what we could grow in the gardens and about playing in the barn though. Somewhat bittersweet. I also felt bad that I didn't recognize her. I'm terrible with faces. I think she felt awkward asking to look but I completely understood. I've looked at google earth images of places we used to live and wished I could visit to see how they look now.

As an aside, my friend may be getting fired from his job. They haven't responded to any of his texts, e-mails, calls etc to send repair parts so he can't do his job to fix stuff. He found out they interviewed someone for his position but the person failed the drug test. The worst part is that they haven't sent his last paycheck yet. Mind you, I don't blame them for wanting to fire him. He barely shows up for work anymore because most of the time he's stuck watching the baby and he has health issues. He can't drive in the rain or when it is even slightly dark because he can't see. He's not doing well since the stroke. He should be on disability. But, not paying him for work he did is inexcusable.

And the news just said prices of food will go up at least 7% next year.

Internet is being very slow tonight-- this site in particilar. It's not letting me use reactions to posts and I had trouble loading the main page. I clicked a reaction 5 minutes ago and it still shows a loading bar.

Ok, reloaded and its working now. Sheesh.

Jay, that reminds me of the time I was in Walmart and some man was berating his wife, calling her stupid, & even grabbed her by the arm and yanked her away & threatened her. I went into ragemode and got up in his face (this was years ago), called him an a-hole and told him to knock off the domestic violene before he got knocked on his a$$. He looked totally shocked. The woman was crying but she quietly thanked me. I do not tolerate that kind of bs.

I had a visit from someone who used to work with my father. She wasn't coming to visit us, she & her family wanted to see the house & yard because a relative had just died & they apparently used to live here (owned it before the people who sold the place to us did). For one, it was a reminder that my father is gone, also learned that it was one of my nicer neighborhood people who died, and I felt sad that the place was in such bad condition. Busted up car port, knocked down front gate, broken fences, barn is falling apart, house exterior needs to be pressure washed-- junk all over the porch, a ding on the edge of the roof over the porch... I wanted them to see it in better condition. We did reminisce about what we could grow in the gardens and about playing in the barn though. Somewhat bittersweet. I also felt bad that I didn't recognize her. I'm terrible with faces. I think she felt awkward asking to look but I completely understood. I've looked at google earth images of places we used to live and wished I could visit to see how they look now.

As an aside, my friend may be getting fired from his job. They haven't responded to any of his texts, e-mails, calls etc to send repair parts so he can't do his job to fix stuff. He found out they interviewed someone for his position but the person failed the drug test. The worst part is that they haven't sent his last paycheck yet. Mind you, I don't blame them for wanting to fire him. He barely shows up for work anymore because most of the time he's stuck watching the baby and he has health issues. He can't drive in the rain or when it is even slightly dark because he can't see. He's not doing well since the stroke. He should be on disability. But, not paying him for work he did is inexcusable.

And the news just said prices of food will go up at least 7% next year.

- Joined

- Dec 3, 2017

- Messages

- 21,534

While this is not good, I have anticipated much worse.And the news just said prices of food will go up at least 7% next year.

- Joined

- Sep 4, 2020

- Messages

- 11,085

The better one is prepared the easier it will be to navigate the stagflation waters. Preps give one the option to wait for better deals or negotiate for what us needed. Those that do not prep can feel desperation and drive inflation.While this is not good, I have anticipated much worse.

We do the world a service by not falling into the trap of desperation. The world SHOULD thank the preppers some day.

Ben

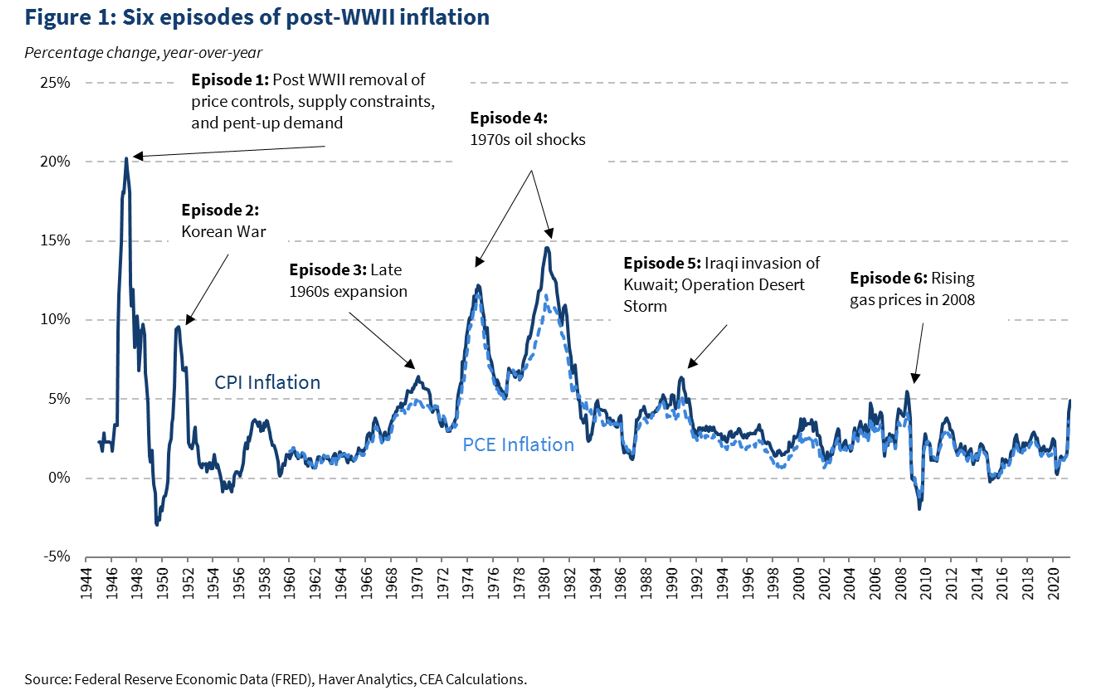

Looks like it's going to be 1974 again!The better one is prepared the easier it will be to navigate the stagflation waters. Preps give one the option to wait for better deals or negotiate for what us needed. Those that do not prep can feel desperation and drive inflation.

We do the world a service by not falling into the trap of desperation. The world SHOULD thank the preppers some day.

Ben

Inflation was above 5% for 8 years!!!

Notice how vertical the last part of the line on the graph is. (good thing the chart was done in July!

From The White House's own website:

Come relive history with me!

(They are just trying to lube us up for the interest-rate hikes on the way. Bend over!

Last edited:

Our friend passed away last night. At least she went fast.

My sympathy Havasu.

My parents ran a gas station in 1974, some Jackball blasted our price sign with a shotgun when we put the hoods up on the pumps, I can see where he'd be pissed after waiting an hour (or two!) but still..

Dad plugged four rounds of 38 into his car and mom threw me behind the counter while she got the 22 ready. nobody died but being ten years old and caught in a hillbilly firefight was definitely a life changer!

My parents ran a gas station in 1974, some Jackball blasted our price sign with a shotgun when we put the hoods up on the pumps, I can see where he'd be pissed after waiting an hour (or two!) but still..

Dad plugged four rounds of 38 into his car and mom threw me behind the counter while she got the 22 ready. nobody died but being ten years old and caught in a hillbilly firefight was definitely a life changer!

The better one is prepared the easier it will be to navigate the stagflation waters. ...We do the world a service by not falling into the trap of desperation. The world SHOULD thank the preppers some day.

Aaay-Men, Ben.

jd

I may be ABOUT TO START IDENTIFYING MYSELF AS A RACIST!

presuming that STUPID people are a race unto themselves, I'm starting to think that they are!

If human beings are horses, these morons which I deal with every time I go out have to be donkeys, no wonder so many

vote democrat, they see the picture of the donkey and think:

"Hmm that me! I vote that! durr hurr"

Really my dear, a dollar minus seventy five cents is a quarter. were you too busy with your race based (biased) studies to learn simple F***ing math?! And by the way, that nose stud does NOT go with your half shaved, half purple hairdo and your just found it in a dumpster P***y riot T shirt, is that a band or the last party you were at? Oh, dear sweet goddess... you're apparently pregnant too! Ah, hell. I should at least give you credit for holding a job, wish I still could, but my skill set STARTS at fifteen dollars an hour, not tops off at... Oh gee, that Latin-American looking fellow in the pickup your boyfriend? think he'd sell me a bag of weed if you hooked me up? I'll bet he makes change better than you. the manager? fine. I'll wait, yes, I'm a RICHARD, I'll bother someone over a dollar, its the principle. The nice lady of color comes out, takes one look at my ticket, shrugs, hands me the right change and apologizes. and goes back to her job, meanwhile the my little pony look alike chick is already on Facebook, telling all five of her followers about this jerk she just met. people with an IQ under seventy five should be sterilized at birth regardless of color or creed! gods I am so pissed!

OK, I'm done. AAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAH!!

presuming that STUPID people are a race unto themselves, I'm starting to think that they are!

If human beings are horses, these morons which I deal with every time I go out have to be donkeys, no wonder so many

vote democrat, they see the picture of the donkey and think:

"Hmm that me! I vote that! durr hurr"

Really my dear, a dollar minus seventy five cents is a quarter. were you too busy with your race based (biased) studies to learn simple F***ing math?! And by the way, that nose stud does NOT go with your half shaved, half purple hairdo and your just found it in a dumpster P***y riot T shirt, is that a band or the last party you were at? Oh, dear sweet goddess... you're apparently pregnant too! Ah, hell. I should at least give you credit for holding a job, wish I still could, but my skill set STARTS at fifteen dollars an hour, not tops off at... Oh gee, that Latin-American looking fellow in the pickup your boyfriend? think he'd sell me a bag of weed if you hooked me up? I'll bet he makes change better than you. the manager? fine. I'll wait, yes, I'm a RICHARD, I'll bother someone over a dollar, its the principle. The nice lady of color comes out, takes one look at my ticket, shrugs, hands me the right change and apologizes. and goes back to her job, meanwhile the my little pony look alike chick is already on Facebook, telling all five of her followers about this jerk she just met. people with an IQ under seventy five should be sterilized at birth regardless of color or creed! gods I am so pissed!

OK, I'm done. AAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAH!!

I will just point out that donkeys tend to be much smarter than horses.I may be ABOUT TO START IDENTIFYING MYSELF AS A RACIST!

presuming that STUPID people are a race unto themselves, I'm starting to think that they are!

If human beings are horses, these morons which I deal with every time I go out have to be donkeys, no wonder so many

vote democrat, they see the picture of the donkey and think:

"Hmm that me! I vote that! durr hurr"

OK, I'm done. AAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAH!!

- Joined

- Feb 12, 2020

- Messages

- 4,302

I feel you on the stupid people thing.

Speaking of stupid, when my brother went to set up a Roth IRA at Capitol One, the clerk was so dumb she didn't know how to do it. She ended up putting it in to a regular IRA which had a lower interest rate. ALL of his statements said that it was a regular IRA instead of Roth. When he asked the bank to fix it, they refused. So he let it drop. That bank closed (the local branch anyway) and we encouraged him to switch it to a better local bank. At first CO told him it couldn't be done. He then contacted the other bank and they had him fill out the paperwork to roll an IRA to a Roth IRA at their bank. So he submits the paperwork and gets a call back from the bank saying that CO is now claiming it was a Roth IRA all along so he needs to fill out more paperwork saying he wants to roll from a Roth to another Roth. I think CO is trying to stop him from getting his money out of their bank. We'll have to see. The teller told him since he had already submitted paperwork and signed it that they would do the request for him and see how it goes. Watch them try to claim its not a Roth IRA though.

Meanwhile, he was checking his bank and cc statements and saw a $1 charge pending for Dallas Institute of Visual Learning. He'd never heard of it. He contacted Discover and told them that he didn't authorize it, didn't know what it was or how they got his CC # and told them to block it. He then got an e-mail from DIoVL asking him why he canceled his "donation". He explained that he'd never heard of them and didn't agree to donate anything to them. They then said "But it's ONLY $1!" He told them "That's $1 I earned & not yours to take". They also indicated that they would continue to try to charge it to his card so he had to cancel his card and get a new one. Discover told him that DIoVL had set it up as a recurring charge so they were going to keep charging him and hope he didn't notice. No idea how they got his e-mail address or his CC but I guess something he bought or subscribed to sold his info to them.

Speaking of stupid, when my brother went to set up a Roth IRA at Capitol One, the clerk was so dumb she didn't know how to do it. She ended up putting it in to a regular IRA which had a lower interest rate. ALL of his statements said that it was a regular IRA instead of Roth. When he asked the bank to fix it, they refused. So he let it drop. That bank closed (the local branch anyway) and we encouraged him to switch it to a better local bank. At first CO told him it couldn't be done. He then contacted the other bank and they had him fill out the paperwork to roll an IRA to a Roth IRA at their bank. So he submits the paperwork and gets a call back from the bank saying that CO is now claiming it was a Roth IRA all along so he needs to fill out more paperwork saying he wants to roll from a Roth to another Roth. I think CO is trying to stop him from getting his money out of their bank. We'll have to see. The teller told him since he had already submitted paperwork and signed it that they would do the request for him and see how it goes. Watch them try to claim its not a Roth IRA though.

Meanwhile, he was checking his bank and cc statements and saw a $1 charge pending for Dallas Institute of Visual Learning. He'd never heard of it. He contacted Discover and told them that he didn't authorize it, didn't know what it was or how they got his CC # and told them to block it. He then got an e-mail from DIoVL asking him why he canceled his "donation". He explained that he'd never heard of them and didn't agree to donate anything to them. They then said "But it's ONLY $1!" He told them "That's $1 I earned & not yours to take". They also indicated that they would continue to try to charge it to his card so he had to cancel his card and get a new one. Discover told him that DIoVL had set it up as a recurring charge so they were going to keep charging him and hope he didn't notice. No idea how they got his e-mail address or his CC but I guess something he bought or subscribed to sold his info to them.

How many thousands, especially our senior citizens, are being duped by this fraudulent activity?I feel you on the stupid people thing.

Speaking of stupid, when my brother went to set up a Roth IRA at Capitol One, the clerk was so dumb she didn't know how to do it. She ended up putting it in to a regular IRA which had a lower interest rate. ALL of his statements said that it was a regular IRA instead of Roth. When he asked the bank to fix it, they refused. So he let it drop. That bank closed (the local branch anyway) and we encouraged him to switch it to a better local bank. At first CO told him it couldn't be done. He then contacted the other bank and they had him fill out the paperwork to roll an IRA to a Roth IRA at their bank. So he submits the paperwork and gets a call back from the bank saying that CO is now claiming it was a Roth IRA all along so he needs to fill out more paperwork saying he wants to roll from a Roth to another Roth. I think CO is trying to stop him from getting his money out of their bank. We'll have to see. The teller told him since he had already submitted paperwork and signed it that they would do the request for him and see how it goes. Watch them try to claim its not a Roth IRA though.

Meanwhile, he was checking his bank and cc statements and saw a $1 charge pending for Dallas Institute of Visual Learning. He'd never heard of it. He contacted Discover and told them that he didn't authorize it, didn't know what it was or how they got his CC # and told them to block it. He then got an e-mail from DIoVL asking him why he canceled his "donation". He explained that he'd never heard of them and didn't agree to donate anything to them. They then said "But it's ONLY $1!" He told them "That's $1 I earned & not yours to take". They also indicated that they would continue to try to charge it to his card so he had to cancel his card and get a new one. Discover told him that DIoVL had set it up as a recurring charge so they were going to keep charging him and hope he didn't notice. No idea how they got his e-mail address or his CC but I guess something he bought or subscribed to sold his info to them.

That activity seems ok by our Feds, but hold an American Flag at the Capitol on January 6th, 2020, and you won't see the light of day. This country is royally screwed up!

I finally granted Capital One a divorce.I feel you on the stupid people thing.

Speaking of stupid, when my brother went to set up a Roth IRA at Capitol One, the clerk was so dumb she didn't know how to do it.

They sent me a notice that they were cutting my credit card limit in half because I wasn't using enough of it.

I called them up and got passed to a (stupid) 'supervisor'. I explained to him that it was my 'emergency money' in case something bad happened, I would have it to fall back on. He talked about a half hour basically telling me they didn't give a dam and were going to cut the limit and there was nothing I could do about it.

.... Evidently they had never dealt with a true a-hole before.

I put that card in "credit card hell" also known as: the top dresser drawer, (I had plenty of other cards).

Every 3 years they would send me a letter saying that they were going to close the account and that was my cue to buy a case of beer with it.

They had to keep my account open, and on the books, without making a dime off it, while it sat in the drawer, for 8 YEARS!

In the end I cashed out my reward points and did not deposit the $4 check.

That will be a thorn in their side for all eternity.

What's that old saying? "Payback is a beach"?

Last edited:

I had exactly the opposite problem several years ago. Back then, I did not trust shopping on the internet. And credit card companies were making customers responsible for more of a questionable charge than they are these days.They sent me a notice that they were cutting my credit card limit in half because I wasn't using enough of it.

I applied for, and got, my "internet only" credit card. I called them and asked them to set the credit limit to $500. An amount that I did not plan to exceed for internet purchases. And, the amount I was willing to "risk" to internet fraud.

You should have seen them howl over such a low limit. I had to escalate several times before I finally got to someone who would do as I asked. I guess they don't like cards that are paid in full every billing cycle, and that won't be seeing high dollar purchases due to a low credit limit.

Nowadays, customers are not responsible for much of anything if a fraudulent charge shows up, so a low credit limit is not as necessary as it once was. We still have an "internet only" credit card, but that is for our convenience. If it does get a false charge on it or some merchant reports their database was hacked, we only have to cancel one card that is used for all our online purchases. Typically, the credit card issuer notices a potential problem well before we do (we check each monthly statement, but that only happens when we go to pay the bill). We've had a couple of cards canceled by the issuer and replacements sent due to whatever fraud prevention they do on purchases. Several years ago, simply going on vacation in a different state could get you in trouble if you didn't pre-notify your card issuer. That doesn't seem to be a problem these days though. I just went to Hawaii without notifying my card issuers and my cards worked just fine. Probably because these days they know everything about each of us already. Their computers probably said, "Oh, his daughter lives there now, so this purchase is probably OK."

Last edited:

I finally granted Capital One a divorce.

They sent me a notice that they were cutting my credit card limit in half because I wasn't using enough of it.

I called them up and got passed to a (stupid) 'supervisor'. I explained to him that it was my 'emergency money' in case something bad happened, I would have it to fall back on. He talked about a half hour basically telling me they didn't give a dam and were going to cut the limit and there was nothing I could do about it.

.... Evidently they had never dealt with a true a-hole before.

I put that card in "credit card hell" also known as: the top dresser drawer, (I had plenty of other cards).

Every 3 years they would send me a letter saying that they were going to close the account and that was my cue to buy a case of beer with it.

They had to keep my account open, and on the books, without making a dime off it, while it sat in the drawer, for 8 YEARS!

In the end I cashed out my reward points and did not deposit the $4 check.

That will be a thorn in their side for all eternity.

What's that old saying? "Payback is a beach"?

My credit unions keep increasing my credit limit. One went from $2500 to $15000 in 3 years. I never carry a balance and pay the full amount before I'm charged interest.

I told my wife I was going to max out all of my cards and disappear.

I could live very well in some 3rd world countries.

I told my wife I was going to max out all of my cards and disappear.

I could live very well in some 3rd world countries.

We have another credit card that kept increasing our limit "because we were such solid and financially responsible customers".

So we went out and bought a car with their credit card. Then promptly paid it off so we didn't have any interest to pay. But only after getting a couple thousand in "cash back for purchases". Thank you credit card company!

Next house we buy, I think we'll put it on MasterCard.

So we went out and bought a car with their credit card. Then promptly paid it off so we didn't have any interest to pay. But only after getting a couple thousand in "cash back for purchases". Thank you credit card company!

Next house we buy, I think we'll put it on MasterCard.

Their mission in the past was to always give the customer way more rope than they needed to hang themselves, in hopes it would ensnare others. Well, some of us have proven that we are 'no fun' because we won't take the bait.I had exactly the opposite problem several years ago. Back then, I did not trust shopping on the internet. And credit card companies were making customers responsible for more of a questionable charge than they are these days.

I applied for, and got, my "internet only" credit card. I called them and asked them to set the credit limit to $500. An amount that I did not plan to exceed for internet purchases. And, the amount I was willing to "risk" to internet fraud.

You should have seen them howl over such a low limit. I had to escalate several times before I finally got to someone who would do as I asked. I guess they don't like cards that are paid in full every billing cycle, and that won't be seeing high dollar purchases due to a low credit limit.

Nowadays, customers are responsible for much of anything if a fraudulent charge shows up, so a low credit limit is not as necessary as it once was. We still have an "internet only" credit card, but that is for our convenience. If it does get a false charge on it or some merchant reports their database was hacked, we only have to cancel one card that is used for all our online purchases. Typically, the credit card issuer notices a potential problem well before we do (we check each monthly statement, but that only happens when we go to pay the bill). We've had a couple of cards canceled by the issuer and replacements sent due to whatever fraud prevention they do on purchases. Several years ago, simply going on vacation in a different state could get you in trouble if you didn't pre-notify your card issuer. That doesn't seem to be a problem these days though. I just went to Hawaii without notifying my card issuers and my cards worked just fine. Probably because these days they know everything about each of us already. Their computers probably said, "Oh, his daughter lives there now, so this purchase is probably OK."

Great minds think alike; I have always had an 'internet-only' card.

If you have read the fine print, you don't have to have a low limit on the card. If you notify them when you receive your bill of a fraudulent charge, it is their money on the line, and their problem. They try to make you think you should worry about it, but no, not if you did what I quoted in red. A few insist that you notify them in writing. I got a stamp.

+1 on raping them with the 'cash back reward' stuff. Float EVERYTHING!We have another credit card that kept increasing our limit "because we were such solid and financially responsible customers".

So we went out and bought a car with their credit card. Then promptly paid it off so we didn't have any interest to pay. But only after getting a couple thousand in "cash back for purchases". Thank you credit card company!

Next house we buy, I think we'll put it on MasterCard.

When I bought the trailer that we used to move down here, I floated it on my card and paid it in full the next month.

Zero interest and here's you a $400 bonus in free money as a thank-you

for using your brain!

for using your brain!

Last edited:

Another perk of some credit cards a few years ago, I don't know if they still do this, was that they would double the warranty of items you purchased with their card. We did call our credit card company to see if this would apply to our new car, but the answer was "I don't know. Probably not." We didn't pursue it further after we checked our printed card holder agreement and saw that there was a limit on doubled warranty coverage amounts that was far below what a car repair would cost. Hey, but it was worth a shot!

I don't remember the exact details, but we could not put the full amount of the car on the credit card. I think we had to write a check for $2000 or something like that. Maybe it was because you can't put car sales tax on a credit card, or maybe it was a dealership policy. I can't remember exactly what the reason was. However, $2000 is a drop in the bucket when talking a car purchase. The vast majority of it was allowed on the credit card.When I bought the trailer that we used to move down here, I floated it on my card and paid it in full the next month.

I remember laughing my butt off when we had wrapped up the price of the car with the salesman and then handed him a credit card. He thought we were joking, started laughing, and said "I don't think this will go through!" Then we said, "No, I think it will." He looked a bit spooked after that and had to go ask his manager how to actually put a car on a credit card (that's when we found out that some parts of the bill couldn't be on the card). As we left I said to the salesman, "What do you bet Taco Bell is going to decline this card when we go pick up lunch?!"

Ridiculously high limits on a card can sometimes come back to bite the card issuer for customers who don't do a running balance month to month. Their problem, not mine.

- Joined

- Dec 8, 2017

- Messages

- 11,926

I had 401k at work & pension, new comers did not get pension, so they could get 401k or Roth 401k. So I stopped my deposits to my 401k & started a Roth 401k. when I retired I had to move my monies to another company, the new company said I could not mix the two together, because of tax laws.I feel you on the stupid people thing.

Speaking of stupid, when my brother went to set up a Roth IRA at Capitol One, the clerk was so dumb she didn't know how to do it. She ended up putting it in to a regular IRA which had a lower interest rate. ALL of his statements said that it was a regular IRA instead of Roth. When he asked the bank to fix it, they refused. So he let it drop. That bank closed (the local branch anyway) and we encouraged him to switch it to a better local bank. At first CO told him it couldn't be done. He then contacted the other bank and they had him fill out the paperwork to roll an IRA to a Roth IRA at their bank. So he submits the paperwork and gets a call back from the bank saying that CO is now claiming it was a Roth IRA all along so he needs to fill out more paperwork saying he wants to roll from a Roth to another Roth. I think CO is trying to stop him from getting his money out of their bank. We'll have to see. The teller told him since he had already submitted paperwork and signed it that they would do the request for him and see how it goes. Watch them try to claim its not a Roth IRA though.

Meanwhile, he was checking his bank and cc statements and saw a $1 charge pending for Dallas Institute of Visual Learning. He'd never heard of it. He contacted Discover and told them that he didn't authorize it, didn't know what it was or how they got his CC # and told them to block it. He then got an e-mail from DIoVL asking him why he canceled his "donation". He explained that he'd never heard of them and didn't agree to donate anything to them. They then said "But it's ONLY $1!" He told them "That's $1 I earned & not yours to take". They also indicated that they would continue to try to charge it to his card so he had to cancel his card and get a new one. Discover told him that DIoVL had set it up as a recurring charge so they were going to keep charging him and hope he didn't notice. No idea how they got his e-mail address or his CC but I guess something he bought or subscribed to sold his info to them.

So I had this giant account with 30 something years of savings & a tiny account with less than $5000.00 in it.

My IRA is a standard account from before the Roth was a thing.

Not sure if this applies or helps.

- Joined

- Feb 12, 2020

- Messages

- 4,302

My mom had some CC companies cancel her cards even though they were getting used but she always paid them off before they could accrue interest. Been using Discover mostly because they don't jerk her around. They did once decline a charge when my family was visiting my sister in Albuquerque though. Discover called the house and I told them I'd get back to them. Called my parents and found out what was going on. I called Discover back from the landline and explained they were traveling to visit a family member so they made note.

I can't remember if I mentioned this one or not, but the other day my friend heard breaking glass and saw some teenagers breaking in to the house his ex's boyfriend bought (the boyfriend is currently out-of-state for work & his ex is still living in my friend's trailer & cheating on her bf with other guys). Anyway, my friend called the cops and went over to chase the kids off. One of them pulled a knife on him. He laughed at them and told them to GTFO. My friend told all of this to the cops when they arrived. Despite the fact that they had stolen property in their possession and my friend had witnessed them breaking in, when the mother of the teens got there, she claimed unless it was on camera there was no proof and it was their word against his. Cops claimed there was nothing they could do and left. Kids have been deliberately walking my friend's house to taunt him and even pulled a knife on his gf's nephew when he was out in the yard of my friend's house playing. My friend called the cops again but they didn't bother to come over. You'd think a band of teens threatening people with a knife- especially pre-teen kids- would at least get a warning from the cops. But they don't care. All they care about are issuing traffic tickets, pestering local restaurants into giving them free food, intimidating people for the mayor, and busting people for drugs if they didn't buy those drugs from the cop who deals them.

I can't remember if I mentioned this one or not, but the other day my friend heard breaking glass and saw some teenagers breaking in to the house his ex's boyfriend bought (the boyfriend is currently out-of-state for work & his ex is still living in my friend's trailer & cheating on her bf with other guys). Anyway, my friend called the cops and went over to chase the kids off. One of them pulled a knife on him. He laughed at them and told them to GTFO. My friend told all of this to the cops when they arrived. Despite the fact that they had stolen property in their possession and my friend had witnessed them breaking in, when the mother of the teens got there, she claimed unless it was on camera there was no proof and it was their word against his. Cops claimed there was nothing they could do and left. Kids have been deliberately walking my friend's house to taunt him and even pulled a knife on his gf's nephew when he was out in the yard of my friend's house playing. My friend called the cops again but they didn't bother to come over. You'd think a band of teens threatening people with a knife- especially pre-teen kids- would at least get a warning from the cops. But they don't care. All they care about are issuing traffic tickets, pestering local restaurants into giving them free food, intimidating people for the mayor, and busting people for drugs if they didn't buy those drugs from the cop who deals them.

- Joined

- Sep 4, 2020

- Messages

- 11,085

Kill that credit card used for the donation!I feel you on the stupid people thing.

Speaking of stupid, when my brother went to set up a Roth IRA at Capitol One, the clerk was so dumb she didn't know how to do it. She ended up putting it in to a regular IRA which had a lower interest rate. ALL of his statements said that it was a regular IRA instead of Roth. When he asked the bank to fix it, they refused. So he let it drop. That bank closed (the local branch anyway) and we encouraged him to switch it to a better local bank. At first CO told him it couldn't be done. He then contacted the other bank and they had him fill out the paperwork to roll an IRA to a Roth IRA at their bank. So he submits the paperwork and gets a call back from the bank saying that CO is now claiming it was a Roth IRA all along so he needs to fill out more paperwork saying he wants to roll from a Roth to another Roth. I think CO is trying to stop him from getting his money out of their bank. We'll have to see. The teller told him since he had already submitted paperwork and signed it that they would do the request for him and see how it goes. Watch them try to claim its not a Roth IRA though.

Meanwhile, he was checking his bank and cc statements and saw a $1 charge pending for Dallas Institute of Visual Learning. He'd never heard of it. He contacted Discover and told them that he didn't authorize it, didn't know what it was or how they got his CC # and told them to block it. He then got an e-mail from DIoVL asking him why he canceled his "donation". He explained that he'd never heard of them and didn't agree to donate anything to them. They then said "But it's ONLY $1!" He told them "That's $1 I earned & not yours to take". They also indicated that they would continue to try to charge it to his card so he had to cancel his card and get a new one. Discover told him that DIoVL had set it up as a recurring charge so they were going to keep charging him and hope he didn't notice. No idea how they got his e-mail address or his CC but I guess something he bought or subscribed to sold his info to them.

The Princess said scammers will use stolen card to donate a dollar to the library since it small and will not be noticed. If it goes through they know the card info is good for them to exploit.

So kill that card ASAP!

Ben